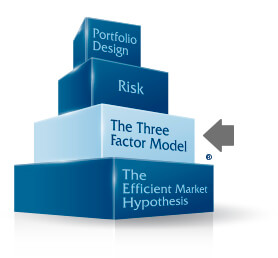

The Three Factor Model

Three factors explain approximately 90 percent of a portfolio’s performance. These three factors, from most influential to least influential, are:

- Stocks vs. Bonds

- Value vs. Growth

- Small vs. Large

These three factors do NOT predict a portfolio’s performance; rather, they explain a portfolio’s performance. Although the factors do not predict a portfolio’s performance, incorporating them can deliver quantifiable expectations for future performance.

Stocks vs. Bonds

Stocks are riskier than bonds, and stocks have, historically, delivered significantly higher returns than bonds. Moreover, stocks can be expected, over time, to continue to deliver higher returns than bonds? Why? Because companies, by definition, must deliver returns that are higher than borrowing costs. Thus, ownership in companies (stocks) will deliver higher returns than loans to companies.

Value vs. Growth

The universe of stocks can be divided in half, with one half being the companies that have a higher book to market ratio than companies in the other half. In short, the “book value” of a company is the value of a company if all of its assets are liquidated and debts paid. The “market value” of a company is all of its outstanding shares of stock times the dollar value of each share. Thus, companies in the half of the market with a high book to market ratio, the Value Companies, have more assets per unit of stock than the Growth Companies, which are those with a lower book to market ratio. Over the long term, value stocks outperform growth stocks.

Small vs. Large

The stocks of small companies tend to earn higher returns than stocks from large companies. The reasons for this phenomenon are numerous and debatable. Nevertheless, over the long term, small stocks outperform large stocks.

Chapter 2 of Great Minds. Great Wealth. Great for Your 401k. goes into the three factor model in detail.”