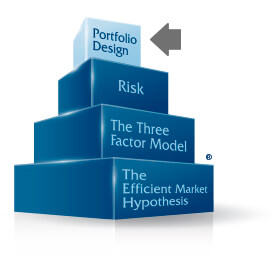

Portfolio Design

The objective of investment portfolio design is for the sum to be greater than its parts while fitting the risk, time horizon and financial objective of the client. In short, an investment portfolio encompasses three areas: the equity versus fixed income ratio,the domestic versus international mix, and the market mix of each global region.

Equity versus Fixed Income Ratio

Equities are stock ownership in a corporation. Because equities are actual ownership, equities have a higher risk and a higher expected return than bonds, or fixed income securities, from the same or a similar corporation.

Increasing the percentage of equities in a portfolio will increase its volatility and its expected return, while increasing the percentage of bonds or fixed income securities will decrease the portfolio’s volatility and expected return. The key for the investment advisor and client is to find the equity to fixed income mix that adequately grows a portfolio while having a volatility that is within the client’s comfort range.

In the Three Factor Model (see Strategy section), the Fixed Income to Equity ratio is the factor that has the most explanatory power for a portfolio’s performance.

Due to mathematical reasons beyond the scope of this discussion, volatility helps while building a nest egg and hurts while harvesting the portfolio.

The Global Mix

Generally, global investments can be split into three general markets: Domestic, International – Developed (Germany, Canada, Japan, Austrailia, etc.) and Emerging Markets (South Africa, Brazil, Czechoslovakia, etc.). As one would expect, Emerging Markets have the highest volatility and Domestic equities the lowest.

Similar to equities, portfolios containing fixed income securities should have a reasonable amount of the fixed income in non-domestic bonds.

The Market Mix

In agreement with the Three Factor Model, the third part of portfolio design concerns value stocks versus growth stocks and small stocks versus large stocks. Value versus growth, the second most significant factor in the three factor model, stretches across the equity size spectrum; i.e., there is a value versus growth split between stocks in the various size ranges such as small stocks, middle market stocks and large stocks.

The value versus growth and large versus small characteristics also hold for non-domestic stocks, so the Three Factor Model should be applied in each of the three general markets: Domestic, International – Developed and Emerging Markets.

Real Estate

Real Estate is a good diversification investment, as it has similarities to both equity and fixed-income securities. Hence, portfolios should have a small percentage invested in real estate.

The Ideal Mix

Based on Nobel Prize winning work by Harry Markowitz first done in the 1950s, with the right tools and investment options an advisor can create a scientifically designed portfolio that improves the risk/return characteristics beyond what the different pieces have individually. Fortunately, analytical tools exist that can aid the portfolio design process; however, such tools must be applied with caution because of their limitations.

Chapter 4 of Great Minds. Great Wealth. Great for Your 401k. uses a kitchen example to explain portfolio design before moving on to how the information resulted in a Nobel Prize for making the sum of a portfolio’s parts perform better than each part in isolation.